Gas reimbursement calculator

How do you calculate gas mileage reimbursement. Get the best prices at the perfect time.

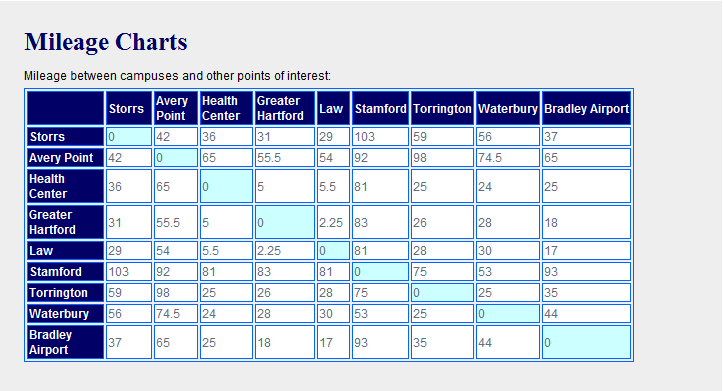

Mileage Calculation Accounts Payable

575 cents per mile for business miles 58 cents in 2019 17.

. Rate per mile. Step 3 Optionally enter your miles driven for moving. Find the cheapest gas stations on your route with this.

If use of privately owned automobile is authorized or if no Government-furnished automobile is available. Pay driving employees for the business use of their personal vehicle. When doing so next time.

For this year the mileage rate in 2 categories have gone down from previous years. Select your tax year. Type the location name in the From and To fields.

Using a mileage rate The standard mileage rate is 56 cents per mile. Gas mileage reimbursement calculator helps you to compute your entitlement to gas mileage reimbursement as per the gas mileage reimbursement rates for 2020 announced by IRS in. Enter the current mileage reimbursement rate.

For example lets say you drove 224 miles last month and your employer. Enter applicable statelocal sales taxes and any additional feessurcharges. For a location missing from the drop down type a street.

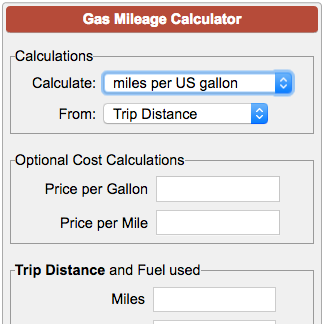

This calculator can estimate fuel cost according to the distance of a trip the fuel efficiency of the car and the price of gas using various units. Click on the Calculate button to determine the. For example if the standard reimbursement vehicle gets 225 mpg and the gas prices are 550gallon.

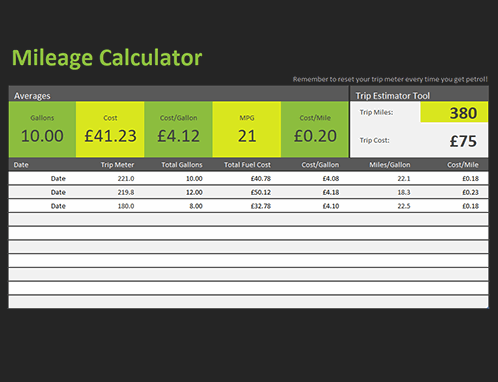

Calculate car miles per gallon or MPG by entering odometer readings and gallons or entering actual mileage. A simple gas trip calculator to estimate how much fuel your vehicle consumes and uncover if your car is a gas guzzling machine. So the new standard mileage reimbursement rates for the use of a car also vans pickups or panel trucks from on January 1 2021 will be.

An easy way to calculate gas mileage is to remember the odometer reading or to reset the mileage counter when filling up a gas tank. Plan your route estimate fuel costs and compare vehicles. Firstly see the tax year you need to calculate the mileage.

Use latest IRS reimbursement rate for work medical. Enter the estimated MPG for the vehicle being driven. The price of gas may go up.

The purpose of a mileage reimbursement is simple. The more complicated bit is getting that rate right. Select the location from each drop down.

Step 2 Enter your miles driven for business purposes. Calculate the mileage reimbursement for the year 2022. You can gain access to insider knowledge to save money by using the GasBuddy gas calculator.

Try Mileage Reimbursement Calculator. 56 cents per mile driven for business. To find your reimbursement you multiply the.

Gas mileage reimbursement rate for 2020. Get total trip cost and mileage breakdown - mileage rate tracking mileage report gas tolls etc. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year.

The new rate for. Adhering to these principles can improve gas mileage by roughly 15 to 30 at highway speeds and 10 to 40 in stop. Input the number of miles driven for business charitable medical andor moving purposes.

Use the Gas Mileage Calculator. Mileage Reimbursement Calculator instructions. Have a look at these guidelines that are given below to calculate the mileage reimbursement easily by hand.

Step 1 Select your tax year. Calculate fuel economy in automobiles in US or Metric units.

Gas Mileage Log And Mileage Calculator For Excel

Gas Mileage Calculator

2021 Mileage Reimbursement Calculator

How To Calculate Your Mileage For Reimbursement Triplog

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

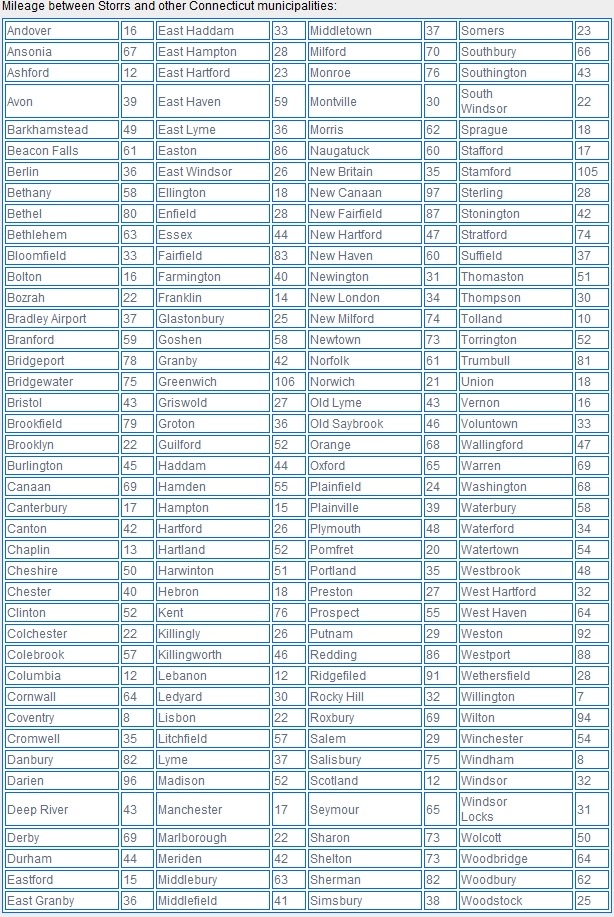

Mileage Calculator

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

Mileage Calculator Credit Karma

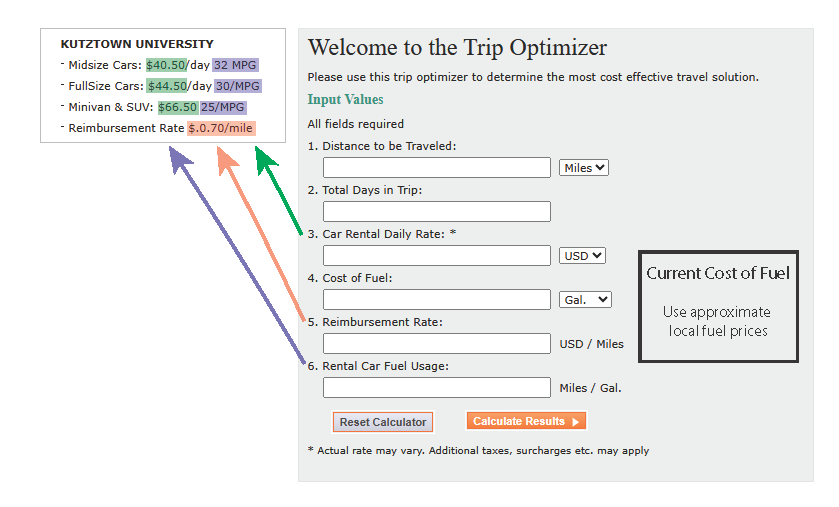

Vehicle Mileage Calculator Kutztown University

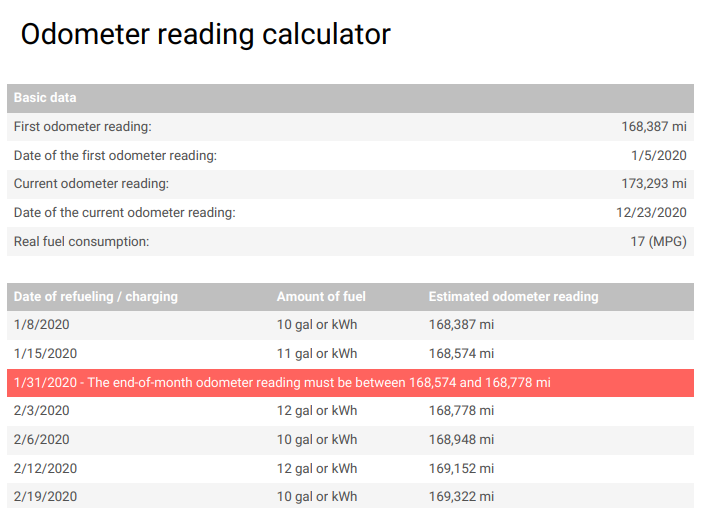

Past Odometer Reading Mileage Calculator Irs Proof Mileage Log

Trip Cost Calculator Fleet Management

Mileage Reimbursement Calculator

Mileage Reimbursement Calculator Mileage Calculator From Taxact

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

Mileage Calculation Accounts Payable

How To Calculate Your Mileage For Taxes Or Reimbursement

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand